Coronavirus and Your Next Conference: To Go or Not?

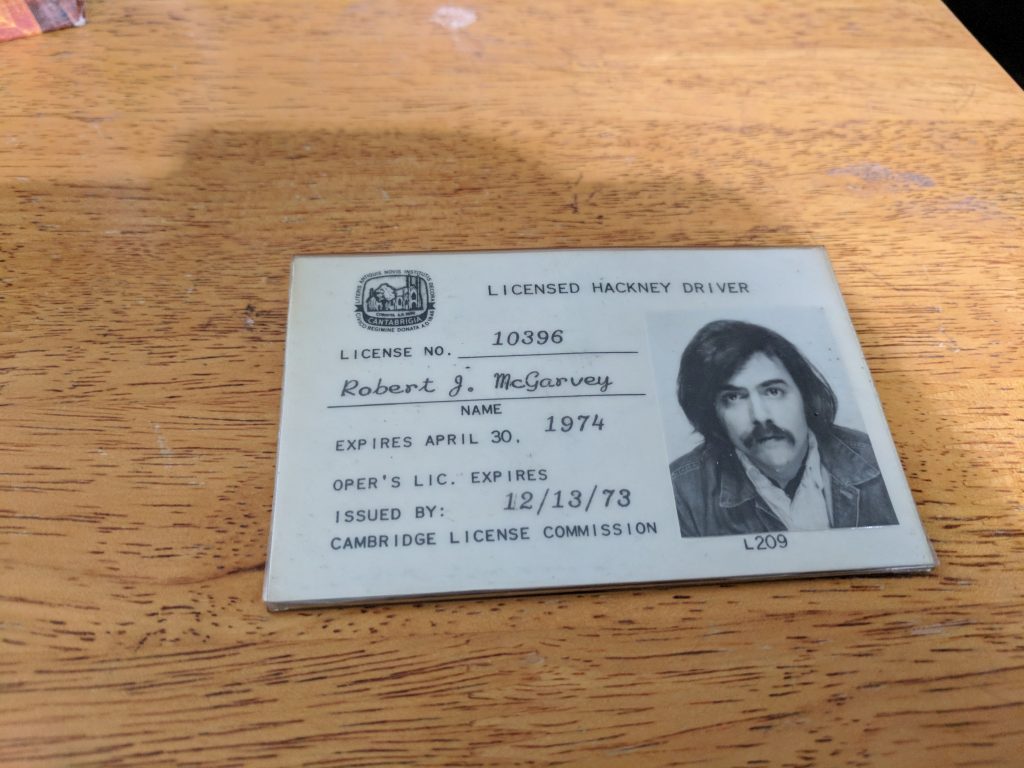

By Robert McGarvey

I am getting a question I never thought I’d be asked: Is it safe to go to a conference- from a public health perspective? Sure, we have heard concerns about terrorism and criminality that sometimes prompt attendees to question when they want to go to another conference, trade show, or similar.

Now I am hearing: Is a public conference suddenly an unsafe place because of health concerns? Note the cancellation of Mobile World…in Barcelona!

Start here: just cross off any conferences you are slotted into in China. Very probably the organizer will cancel anyway. Panic about Chinese meetings and shows, even ones in Beijing (around 600 miles from Wuhan, the apparent epicenter of the coronavirus) and Shanghai (maybe 450 miles distant), is feverish. Air carriers are cancelling all flights to China and the whole country – which is about the same size as the United States – is becoming a giant no-go zone.

People are also telling me they won’t go to Bangkok or Singapore for conferences.

Asia events are easy to figure: the answer is do not go.

It’s the rest of the world where there are questions – even events at home in the US, where there have been exactly zero deaths attributed to coronavirus as of this writing.

Yet panic is rising, at a level I do not recall ever seeing in the US or Europe. Sure, there was anxiety around SARS in 2003, an epidemic that hopscotched globally, infected perhaps 8000 and killed maybe 800.

But coronavirus – right now, today – is terrifying a lot more people. Surgical masks are selling out globally, even though the CDC advises not wearing them and evidence is scant that they do much to prevent spread of a disease like coronavirus. People are stampeding to try to cancel cruise bookings, an industry that has had horrific quarantines of vessels. Airline flight crews are threatening not to fly. And entire countries are blocking entry of people arriving from China and/or Chinese passport holders.

We haven’t seen exactly that, ever, in our lifetimes (the 1918 flu pandemic is one that rivals the current disease in terms of panic but it killed maybe 50 million in a much less populous world, compared to low five figures for coronavirus deaths – and experts say flu is presently killing more than is coronavirus).

Right now what we have is ignorance that fuels hysteria. We just do not know that much about coronavirus, China is typically opaque and it’s not clear what to do to avoid the disease (other than – obviously – don’t go to China).

But CDC, WHO, and other world health organizations are on this. I am optimistic that we will soon – probably within days – know how the disease spreads, maybe even what caused it in the first place. And then the search for cures commences.

That brings us back to our central question: events and us, what to do?

The answer depends upon your optimism regarding science and coronavirus. If, like me, you think researchers will get a tentative handle on it within weeks, go ahead and commit to conferences certainly in the spring. You may want to hold off on attending big meetings this winter – again, we know little about the disease and that dictates caution in attending large gatherings and spending time in places with recycling air such as planes.

What if we don’t know what we need to about coronavirus within, say, a month? Then you know what hit the fan – in this case, raging fear – and it will get worse, more events will be canceled, and probably we will all sit home for many, many weeks to come. Meaning more decisions will get made for us.

My advice: make flexible reservations with the right to cancel without penalty and, no, not many actual shows will allow that – airlines and hotels do of course, for a premium price; pay it – but my guess is that events sign ups will lag for months to come and many will be welcoming walk ins through this year. It is going to be a very slow year for meetings – use it to your advantage.

Me, I am still planning – happily – on several spring meetings. Have I booked anything yet? Nope. No need to.

Hang loose. Now is the time to do it.