Upgrading the Airport Experience: A Fool’s Errand?

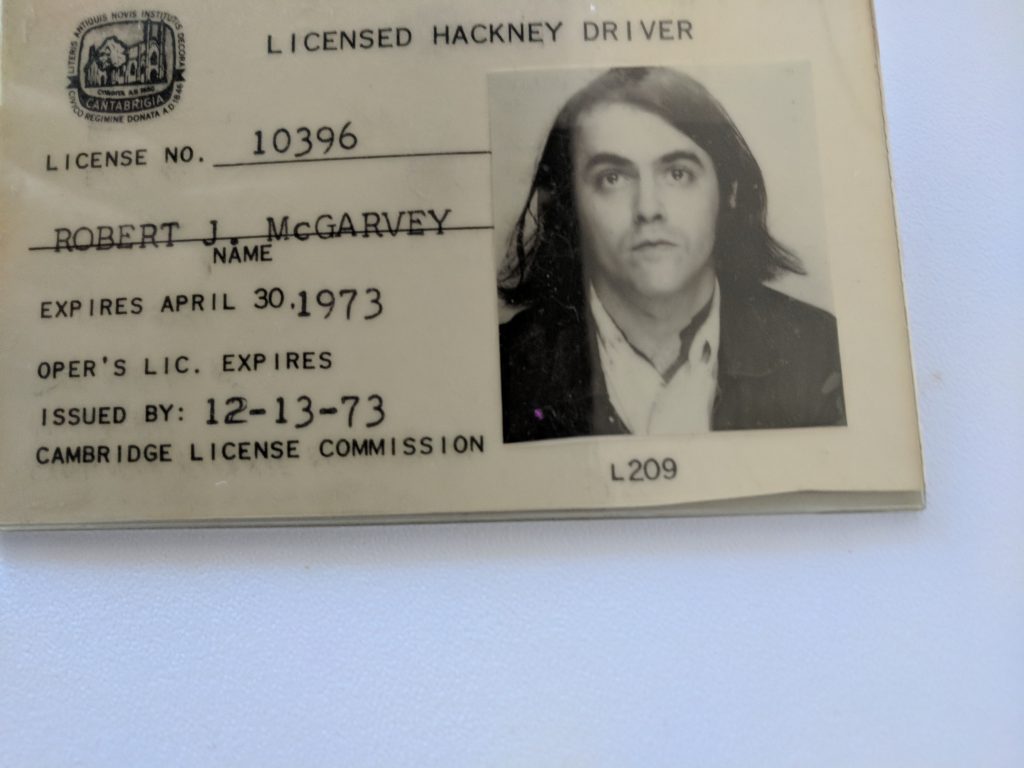

by Robert McGarvey

Delta has figured out that our airport experience genuinely sucks – and it says it wants to fix it. Are you optimistic?

Delta’s CFO, Paul Jacobson, is the bearer of these glad tidings. At a recent CNBC conference, Jacobson said, “I think the next area of competition in air travel is in the airport.”

He added: “How do you continue to streamline the on-the-ground experience. It is a big part of how passengers rate the experience.”

So true. Even with Priority Pass, Amex Platinum, Global Entry, and Diner’s Club along with a couple airline credit cards, I dread the airport experience. Where I live, Phoenix, it’s actually not that bad. I live 30 minutes away from PHX via lightrail, the security lines are predictable (and usually short), and it’s an airport where little seems to go awry. When a Centurion Lounge opens in 2020, life will indeed be good.

Delta, incidentally, already has a lounge at PHX. It’s gotten good ink – but count me a Centurion loyalist.

The problem is that I go to PHX to fly elsewhere and the other airports – such as EWR, JFK, DFW – are circles in Dante’s Inferno.

Enter Delta with a $12 billion war chest earmarked for airport upgrades – specifically at LaGuardia, LAX, Seattle, Salt Lake City and Atlanta.

Airlines nowadays are flush with cash and the big carriers seem persuaded they have upgraded the inflight experience as far as they can go, so what’s next on the fix it list? Airports are definitely a mess and indeed we do blame the carrier for our woeful airport experiences.

But is this fixable? By an airline?

Honestly, even clubs, the frequent traveler’s cure for airport misery, are rapidly deteriorating. Journalist Chris McGinnis recently filed a story in the San Francisco Chronicle that was headlined, Crowding pushes airport lounges to raise prices, limit access. The subhead was even gloomier: Finding respite from airport mobs getting tougher.

Wrote McGinnis, “due to their popularity, lounges are getting as crowded as airport terminals.” Club operators are deploying various strategies to better manage, indeed limit, access – but still the complaints grow that at many airports the clubs no longer count as sanctuaries.

I’ve even heard complaints that there was no place to sit in a Centurion, and no place to recharge a phone. Reports of overcrowding at Centurions are plentiful.

Of course club woes are just a symptom of what ails airports today. The short answer is just about everything.

The problem is known: the US just hasn’t opened a new airport in decades (Denver, 1995) and it hasn’t expanded airports to meet demand. Around a billion passengers clog US airports each year and that infrastructure was built to handle maybe half that passenger load. In boom times, like now, the limitations of the infrastructure become painfully obvious.

As far back as 2013, the Washington Post ran a story headlined: Reports say U.S. airports are dangerously close to capacity. Per the story: “Failure to invest in airports and the aviation system will result in a steady increase in airport congestion.”

Five US airports rank among the world’s busiest: Atlanta, LAX, DFW, Denver, Chicago O’Hare.

J. D. Power even ranks the country’s most hated airports. LaGuardia wins the prize, nosing out Newark.

What’s the solution? A massive airport instructure renewal plan is just about the only way out. According to the U.S. Travel Association, $130 billion is needed over the next four years for infrastructure involving airports.

Just about everything here is broken. We need more terminals, more runways, more parking spaces, more and better roads leading to the airports, more public transit to and from the airports.

China, by way of contrast, has 236 airports it will build by 2035. That will essentially double the nation’s airport capacity. China also is furiously building roads, bridges, and the rest.

The US, meantime, has made no progress in addressing an airport issue that most experts believe started perhaps thirty years ago. The problems aren’t new, they are years in the making, and what’s needed to do fixes is political will and investment dollars.

Which brings us back to Delta and its $12 billion upgrade fund. The carrier deserves applause – the other big carriers ought to pony up as well – but I just don’t see these efforts having the clout and the cash needed to make fundamental changes in our airports. Of course it’s all nice but nice won’t result in the changes we need.

We need a bold plan that aims to provide an airport infrastructure that will work at least through 2050. Call it a 30 year plan. Anything less just won’t do what we need.

Are any significant politicians showing support for bold air transportation initiatives? Not that I am aware of. That’s a shame.

The future of flying in the US is heading towards more gloom, more crowding, more hectic hours at airports. It doesn’t have to be that way. But until we mount a coherent, sweeping program that’s what we are likely to get.