Fiserv Core Flaw Exposed Customer Data at Hundreds of Banks: Security Researcher

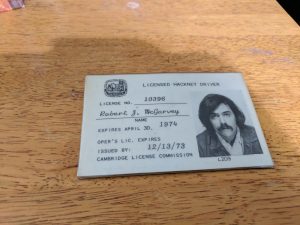

By Robert McGarvey

Highly regarded security researcher Brian Krebs has published a bombshell report that maintains a flaw in some Fiserv banking technology leaves customer data potentially exposed to criminals.

Krebs does not finger credit unions that may have fallen victim to this but there is no reason to think some aren’t.

Krebs credited the flaw discovery to independent security researcher Kristian Erik Hermansen who noticed that when he setup an alert on his bank account, the alert was assigned an event number. So Hermansen, on a hunch, tried to log into an event number a digit different and what he found was that he indeed could log in. This matters because, said Krebs, “In an instant, he could then view and edit alerts previously set up by another bank customer, and could see that customer’s email address, phone number and full bank account number.”

That means a criminal could add his email address to the account and get alerts on, for instance, all transactions.

Krebs also noted that a criminal could hunt for customers who had set up high minimum balance alerts – $5000, say. Which would tell the crook he could siphon out $4999 and he might be undetected for some time.

Krebs said he personally signed up for accounts at two small banks that use Fiserv. Here’s what he found: “In both cases I was able to replicate Hermansen’s findings and view email addresses, phone numbers, partial account numbers and alert details for other customers of each bank just by editing a single digit in a Web page request.”

He said he found “hundreds” more banks with similar vulnerabilities.

Krebs told Fiserv what he had discovered. The company responded this way: “Fiserv places a high priority on security, and we have responded accordingly,” Fiserv spokesperson Ann Cave said. “After receiving your email, we promptly engaged appropriate resources and worked around the clock to research and remediate the situation. We developed a security patch within 24 hours of receiving notification and deployed the patch to clients that utilize a hosted version of the solution. We will be deploying the patch this evening to clients that utilize an in-house version of the solution.”

Cave elaborated to Credit Union Times: “This is related to a one-way messaging feature on a limited number of bank websites. Upon notification, we promptly developed a patch to update the feature, deployed the patch to clients using the feature and completed testing to confirm the issue has been fully resolved. Our ongoing research and continued monitoring have not identified, and we have not received reports of, any adverse consumer impact.”

There is no count of the number of websites impacted by this flaw.

Any credit union running a Fiserv core and/or online banking ought to quickly contact Fiserv and inquire into the availability of that patch. They ought also to see if they can replicate Krebs’ hack of the alerts system. And – above all else – check your own systems to see if you can replicate the Hermansen hack.

If you can, take action.

Krebs said that, in his inspection, the Fiserv patch in fact works. “This author confirmed that Fiserv no longer shows a sequential event number in their banking sites and has replaced them with a pseudo-random string.”

But Fiserv is not blowing trumpets to announce the patch or the flaw.

A scan of Fiserv’s Twitter feed found no mention of the flaw or Krebs’ reporting or the purported patch.

There’s silence over at Facebook too.

Julie Conroy of Aite told Krebs this about Fiserv’s customers: “These financial institutions use a core banking provider like Fiserv because they don’t have the wherewithal to do it on their own, so they’re really trusting Fiserv to do this on their behalf,” Conroy said. “This will not only reflect on Fiserv’s brand, but also it will impact customer’s perception about their small local bank, which is already struggling to compete with the larger, nationwide institutions.”

What she is saying is that big banks – that ordinarily don’t buy off the shelf technology from a Fiserv – may have a competitive advantage because they build their own.

I’m not sure that is true – I doubt most consumers have a clue as to whether their bank or credit union technology is off the shelf or bespoke.

But Conroy is right: in some ways the big banks keep expanding their technology lead over small institutions. That does not have to be the case. A smart credit union can use fintech alliances to create an institution that is the rival of even the most polished money center banks.

But the credit union has to want to get there.

And a necessary first step is cleaning up that Fiserv mess if your institution is a victim. Do it now.