Are You a Points Addict?

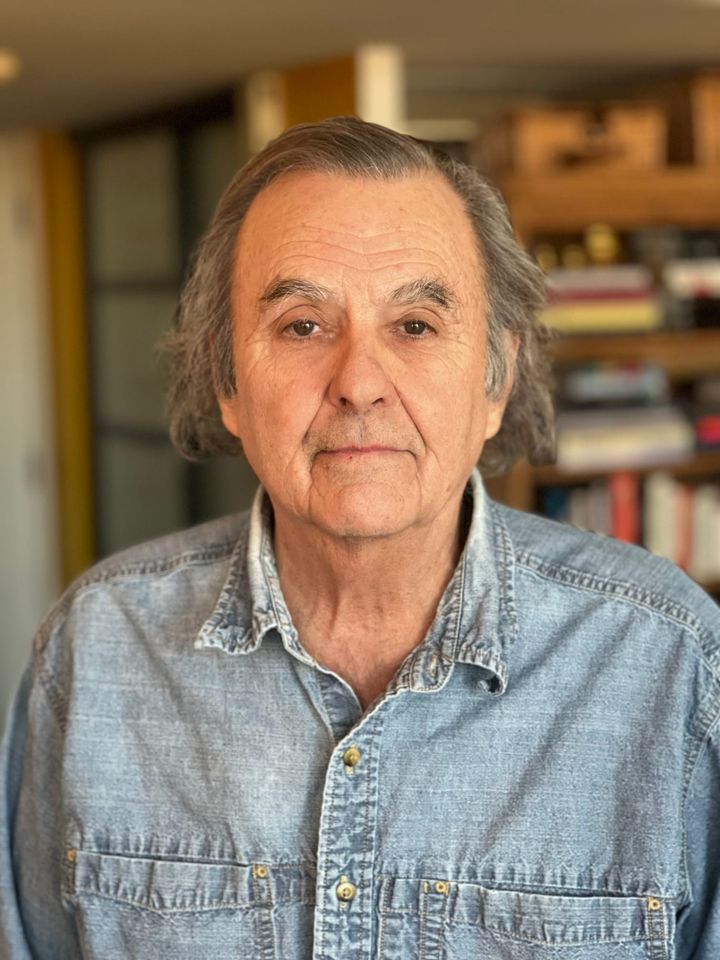

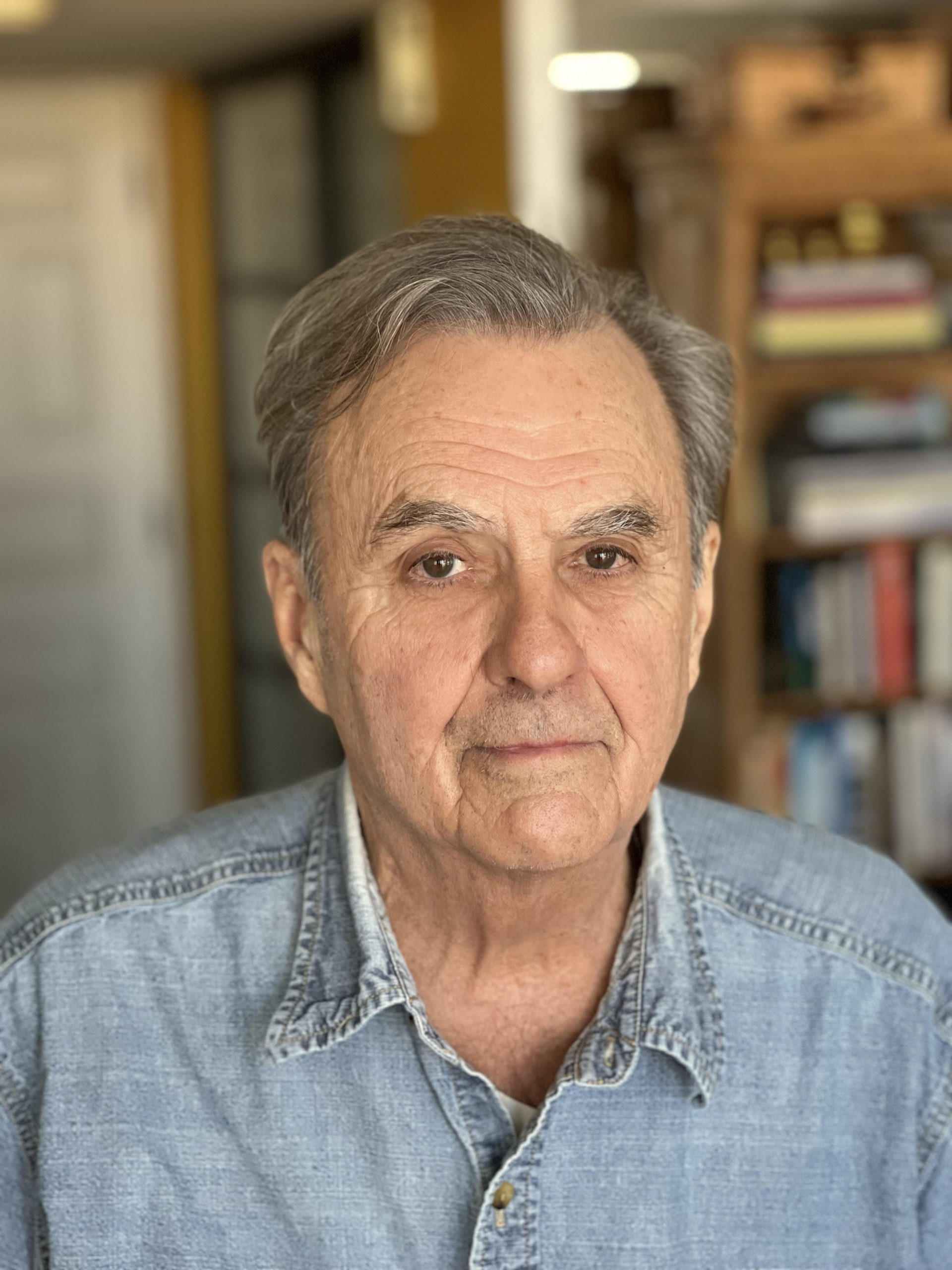

by Robert McGarvey

My name is Bob and I am a points addict.

Actually I am not and in this blog I will explore the Siren call of points and how I managed to escape the trap. Just barely. It has become terribly easy to be seduced by the allure of points as a free passport to, well, anything you desire. But it is not that easy or even that honest.

Understand, for starters, I mean no disrespect to real 12 step programs. AA has been of enormous benefit to close friends of mine, also family.

I also do not know if there is some kind of program that aims to help points addicts. But there should be because, honestly, it has become very, very easy to slip into a mindset where it becomes crucially important to score this 500 point bonus here, that triple point bonanza there and, along the way, why the hell not get a new Alaska Air card because it comes with 60,000 miles and who cares if I don’t recall flying Alaska in a quarter century.

I see the headline and indeed my heart beats – Get a new Jag, get 50,000 United miles. Yes, I know Jags are unreliable pieces of rolling junk and have been for a decade or longer. Classic Jags – pre the Ford purchase of the marque in 1999 – have undeniable beauty, swagger even, that may cancel out the reliability question and, besides, by the time a car is 25 it really does not matter what its reliability was when it rolled off the assembly line. Would I love an old Jag? Very possibly and I still regret letting an old Jag that was in the family slip away. But a new one?

Even so…50k United miles.

And then there is the “mystery” bonus – free miles on United and American – limited time only and what miles you get varies depending upon…well, who knows? Free miles are free miles. Do you click the links? Warning: probably those promotions have expired. The real question is, did you click the links when they were live? Did you get the bonuses?

Personally I did and I didn’t. I clicked the link, saw my bonus (500 miles after spending $125 on my United Explorer card) but…I caught myself. I have no rational plan for accumulating enough United miles to matter and presently I have but a handful and an extra 500, or 625 after the needed purchase, won’t make an iota of difference. I’ll still have a useless handful.

But I caught myself.

I also did not get the pre approved Alaska Air offer, although I will admit it is tempting. But I already have a couple cards I never use (United Explorer I am looking at you) and they may be lonely for companionship but I am not going to stuff my wallet with cards I know I won’t use.

So how do I cope with my almost addiction?

I have my own 2 step program.

Step one: I monitor and severely limit how much time I spend on sites devoted to points addictions. How to identify them? A clue is that the word point or mile is in the site name. Those are the ones to be wary of because, suddenly, you will find yourself clicking around an IHG card application because you just read about a super new offer even though you cannot recall the last time you stayed at an IHG hotel. They toss catnip in our paths and who can resist when you have the addiction propensity?

At one such site the business model hinges on affiliate marketing, a fancy way to describe getting paid finders fees for steering new business. There’s nothing wrong per se with affiliate marketing – I am a fan of the NYTimes WireCutter site which uses affiliate links – but always remember the underlying business model when visiting such sites.

Step two: I limit my real points hunt to offers and rewards on Amex Plat and, yes, the need to search annoys me (why not just be nice and give it to me) but if Amex insists on gamifying the experience I’ll play. But only a very little. Maybe five minutes every few weeks looking at my 100 Amex offers.

That’s enough to find hidden little gems. For instance: an Amex offer that gifts me 2000 Amex miles for Spending $3500 – enrollment required. It can gift the points multiple times but the offer is timed (I believe it expires for me at month end). I do nothing to get the bonus. Just use the card as usual.

So now maybe I should re-introduce myself: My name is Bob and I am not a points addict but came close to being one. But not enough to be one.