Mask Wars in the Skies- and Why the Travel Rebound May Fizzle

by Robert McGarvey

On May 11, the TSA’s mask mandate expires and the near-term future of travel hangs on whether or not the agency determines an extension of the mandate is needed.

Updated 4-30-2021: TSA today announced an extension of the mask mandate through September 13. Bravo. Now let’s push the anti vaxxers into doing the right thing and, by late summer, just maybe we can all breathe easier and maskless.

Airlines are vocal in cheering for an extended mask mandate, as are most flight attendants and it is the in-cabin crew who are forced to deal with the angry confrontations and mask refusals as is. At least the TSA edict gives them backup and, in admittedly rare cases, mask refusers have been ejected from planes, even arrested.

Listen up, anti maskers: as the Clash once sang, Know Your Rights. Of course they did not deal with anti maskers, but were they recording today they might agree with my proposed lyric: You have a right to go maskless as long as you fly outside on the wing.

The basic argument for masks is that it lessens the chance of airborne transmission of infectious matter and that is all the more necessary as just about all airlines now are filling middle seats even though the evidence is emphatic that empty middle seats lessen disease transmission on planes. But now Delta, the last of the major carriers to block middle seats, has said they will fill them starting May 1.

We definitely need masked passengers as airlines begin to carry more passengers.

But mask resistance is growing. In Alaska, a state senator – a vocal anti masker – has now been banned by Alaska Airlines, for repeated mask defiance, and this is a bit of a bother for Sen. Lora Reinbold because she lives near Anchorage, the legislature meets in Juneau, and Alaska Air is the only commercial carrier with flights between the two. Reinbold recently made the journey via a 14 hour drive, through Canada, and also involving a water ferry. If anything, she became more vociferous in her anti mask posture. And she has grumbles about the airline: “Alaska Airlines sent information, including my name, to the media without my knowledge nor permission. I do believe constitutional rights are at risk under corporate covid policies,” she wrote on Facebook.

Incidentally, many commented that Canada should have prevented her entry into the state. I would not be surprised if Canada in fact does exactly that when she attempts another drive to Juneau.

Count me as feeling more affection for Alaska Airlines. They are doing the right thing, putting the protection of all passengers above catering to the anti science fantasies of a self important state pol.

But we can top Lora Reinbold. Meet Jessica Alexander, a City councilmember in Temecula CA. Her beef with masks was not about flying as such – it revolved around wearing a mask to council meetings – and Alexander invoked the memory of Rosa Parks, the trigger for the 1955 Montgomery AL bus boycott which was a major event in post war civil rights in the US.

I won’t paraphrase Alexander. Here is how the Press Enterprise recounts her statement: “‘Look at Rosa Parks … She finally took a stand and moved to the front, because she knew that that wasn’t lawful. It wasn’t true,”’ Alexander said, according to a videotape of the meeting. ‘So she took a stand. At what point in time do we? … I’m getting pushed to the back of the bus. This is what I’m telling you I feel like.”

Alexander added that she “cannot” and “will not” wear a mask.

There is no arguing with a person like Ms. Alexander because, well, because it would be a waste of breath.

And the problem is that rising numbers of anti maskers seem to have swallowed alternative reality pills where all manner of anti scientific lunacy is “fact” and their “rights” are getting trampled.

The Voice of America has an intriguing post on what would the founding fathers say to the anti maskers when they insist a mandate requiring mask wearing violates their rights.

Per VOA, “‘These are lawfully created ordinances and mandates and requirements to protect one another. So, that sort of thing would not be seen by the founders as a loss of liberty,’” says Andrew Wehrman, a professor of history at Central Michigan University. “’It’s a mistake to think of liberty as absolute self-indulgence without restraint. We don’t have the liberty to set our own house on fire, because it might affect other houses.’”

To repeat: there is no right not to wear a mask.

Definitely no rights to go maskless on an airplane. But only until May 11. Fingers crossed that TSA does the right, safe, smart thing and extends the mask mandate at least until autumn. Year end would be better.

We need the official mandate. Without it, flying will be a crazytime of delusional anti scientific beliefs.

With the mandate we have a good chance of safe flying.

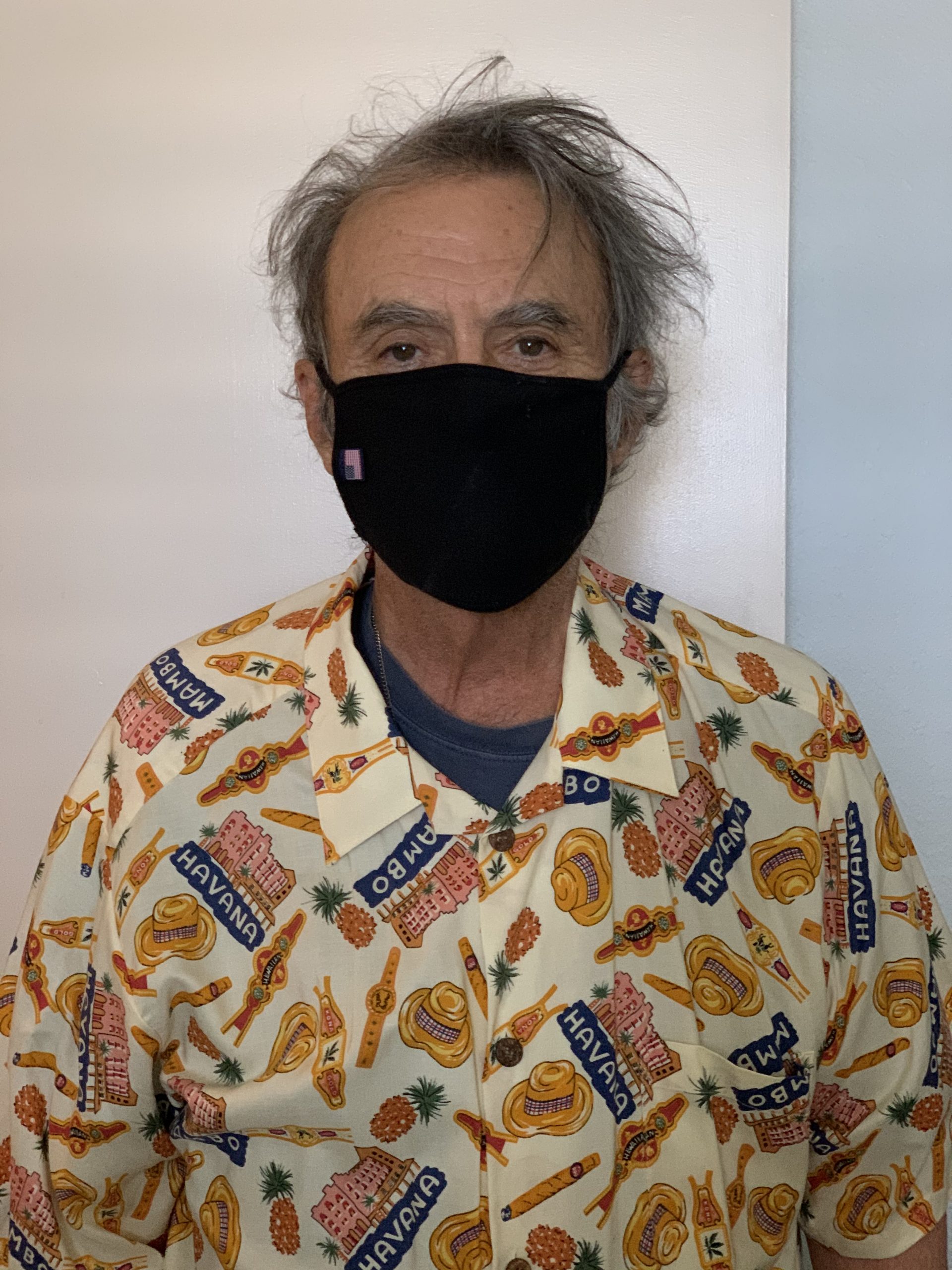

I am masked up. You?